Homebuilder Gurjote Jhaj isn’t quite sure what to make of the recent developments in the housing market.

“There has to be a cap, no? Even $5 million is a crazy price for a Richmond house,” says Jhaj, speaking to the Richmond News in a Brighouse neighbourhood that features wide lots and paved concrete sidewalks lined with trees, not to mention one of the highest concentrations of economic-class immigrants in the country.

Jhaj’s family-based demolition and homebuilding company is busy these days, tearing down the same homes it built only 10-20 years ago. One home, built in 1992 with an original selling price of $280,000, sold last January for $2.2 million; it was torn down by Jhaj and a new home was built on the property, which promptly sold last month for $4.9 million.

“The house doesn’t matter, it’s all about the land. And when someone finds out this price, all these (homeowners) will want $3 million,” explains Jhaj, pointing down what he describes as a quiet, empty road — a stark contrast from his childhood neighbourhood.

Because roughly 85 per cent of investor-class immigrants have come from mainland China, Jhaj’s assertion that all of the new $4-5 million dollar homes — in what used to be a relatively affordable neighbourhood two decades ago — are “being bought by Chinese people” appears logical. Jhaj notes demand for newer homes from Chinese clients has become constant, with his company merely keeping up with market forces.

‘Millionaire migrants’ inflate real estate prices, but don’t boost economy

In the early 1990s, a rush of Hong Kong immigrants came to Richmond, largely through an economic-based immigration program, known as the Business Immigration Program (BIP). With cash in their pockets, a wave of development swept across the city, often in the form of large, brick and pink stucco-style homes, such as the ones on Mang and Chatterton roads, the neighbourhood where Jhaj’s longtime Richmond-based company is presently rebuilding about five homes per year.

The neighbourhood, which was about 70 per cent Chinese in 2011, is indicative of an influx of offshore money from Hong Kong and China over the course of decades, but in particular the last five years, as mainland Chinese buyers spread their wings globally to buy real estate.

It is such money that has inflated housing prices, leaving community and societal costs in its wake, as “collateral damage,” contends University of B.C. geographer Dr. David Ley, author of Millionaire Migrants, a book that links global transnational wealth migration to real estate investment and speculation.

While noting his argument is nuanced, and if taken bluntly it can be inaccurate, Ley contends provincial and municipal government policies to solicit trade and investment with, and to promote immigration from, the Asia Pacific region — in order to reboot struggling local economies — have been short-sighted and ill-planned after examining the impact on property values and livability in Metro Vancouver.

“I’m not saying foreign investment is a bad thing. My point is, there haven’t been enough precautions to consider the unintended consequences for local housing markets the government has generated with the very large take-up of investment and immigration,” Ley tells the Richmond News, on the heels of his peer-reviewed academic study, “Global China and the Making of Vancouver’s Residential Property Market.”

Ley contends financially-driven immigration programs — particularly the investor-class immigrant scheme (part of the BIP), which granted access to Canada for an interest-free $800,000 loan to the federal government — have been particularly problematic.

And while the federal investor-immigrant program is now defunct, it is still operating in Quebec, meaning thousands of such immigrants are thought to be entering Metro Vancouver each year via Quebec (with no financial benefit for B.C. since Quebec receives the loans).

“To some extent it’s a lack of due diligence and a failure to look at the consequences,” says Ley, of the program.

The federal investor-immigrant program was cancelled in 2014, notes Ley, after the federal government realized how little economic benefit the investors were bringing to Canada. On average such immigrants were declaring less income, over time, than refugees. While skilled worker immigrants paid $10,900 in taxes annually after 10 years, investor immigrants paid just $1,400, according to government data (that doesn’t include those who didn’t even file tax returns). And unlike a similar program in the United States whereby entrepreneur or investor immigrants need to employ 10 Americans with a new business, Canada only required one Canadian to be employed by the business-minded immigrant.

“Their source of funds frequently remains offshore, for business immigrants have achieved minimal economic success in Canada,” notes Ley.

The program is said to be important as Chinese nationals seek a better quality of life and/or attempt to funnel their money out of China as the Communist government cracks down on corruption. Of the top-100 most wanted by China’s Fugitive and Repatriation and Asset recovery Office, 26 are believed to be have taken refuge in Canada, notes Ley. And at least one Richmond-based developer, Michael Ching, became politically active, donating to federal Conservatives and Liberals as well as several members of Richmond city council.

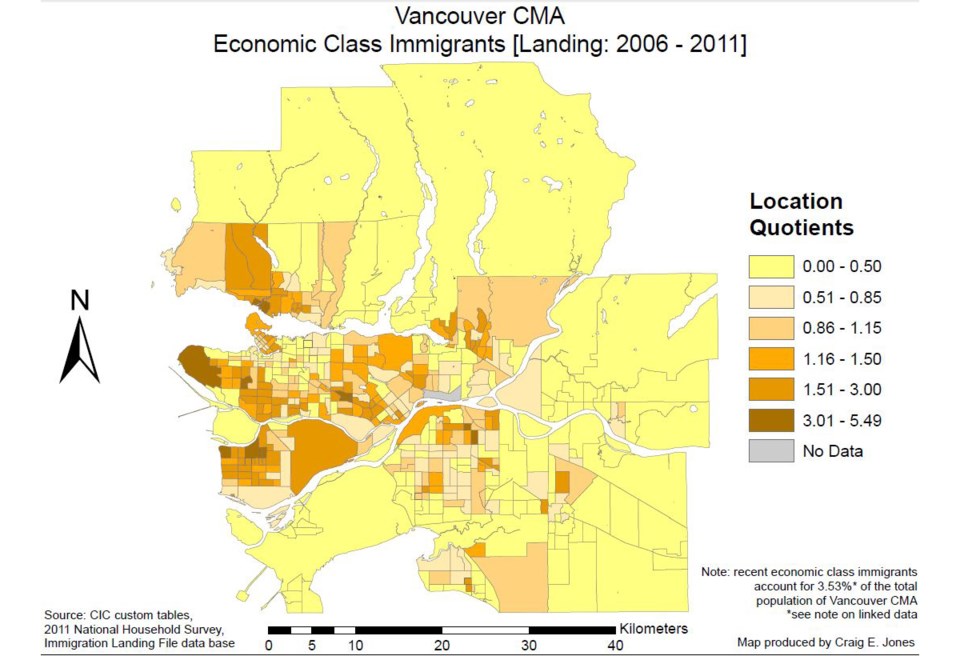

Ley points out that between 2002 and 2014, about 60,000 investor-class immigrants landed in Metro Vancouver. Data shows a high concentration of “economic class” immigrants in Vancouver’s Westside, West Vancouver and tracts of Richmond, including the aforementioned Brighouse neighbourhood, City Centre and Terra Nova. Ley says an unpublished map of investor immigrants shows a “clear ring around the airport.”

UBC geographer Dr. Dan Hiebert, who mined much of that data, notes there isn’t precise proof the investor-class immigrants are buying high-end real estate, such as single-family homes.

However, Hiebert says immigrants on the whole are buying homes in Vancouver “at a rate that’s higher than expected given their (reported) income,” as well as a rate higher than existing residents.

“It’s an overlap as opposed to a relationship. You don’t have that very specific linkage,” notes Hiebert.

Ley said he would be keeping an eye on a new “super visa” program, which has become popular amongst Chinese nationals because one can enter and exit Canada frequently for 10 years.

“It’s set up ideally for people looking for a seasonal home without any requirements . . . I’ve got a feeling this could be very important. It’s new enough that I haven’t done any focused research,” says Ley.

Politicians welcomed foreign investment in real estate in direct and indirect ways

Such policies are largely a result of the broader political economy created in the 1980s by provincial and municipal politicians who sought relief from a declining economy and deflating real estate prices.

“Under these conditions, the right-wing provincial government inaugurated a dramatic series of market-oriented reforms. . . All three levels of Canadian government — municipal, provincial and federal — undertook repeated trade missions” to Asia, through the 1990s.

Ley says Expo 86 was a turning point and the sale of the False Creek lands to a Hong Kong tycoon (with a company marketed as Concord Pacific) became a harbinger of things to come.

More recent trade missions from the City of Vancouver to China are a continuation of this political economy, says Ley, adding the City of Richmond’s support for expanded links to China is another example of soliciting trade and investment. Richmond also recently added two sister/friendship cities, choosing two Chinese cities (it also has a relationship with Wakayama, Japan).

“The enhancement of trade, capital flows and immigration shaped” municipal agendas, notes Ley.

He says politicians have little incentive to change the system, noting the province took in nearly $1 billion in property transfer taxes, last year.

In Richmond, a record $1 billion in construction value was permitted in 2015, with development quickly adding to its tax base.

“Both provincial and municipal government revenues have benefitted from property-based taxation, and are reluctant to harm the goose that lays the golden egg,” notes Ley.

Real measures needed as China’s wealth migration set to explode

Ley notes more conventional drivers of real estate are not necessarily causing Vancouver’s record prices.

He says housing prices have risen even as net domestic migration (from other provinces) to Metro Vancouver has been declining. And average wages have only grown 36 per cent between 2001 and 2014, whereas the average home in Vancouver rose 211 per cent.

That leaves offshore investors. According to Ley’s paper, Chinese buyers spent $5 billion on overseas residential real estate in 2010, $52 billion in 2014 and are projected to spend $220 billion by 2020. This week, the Bank of Canada estimated Chinese investors spent about $12.7 billion on real estate in Vancouver in 2015 (one-third of all sales). Notably, this figure does not include foreign purchasers from other countries.

After much consternation was expressed last year Premier Christy Clark announced she would begin to track foreign home purchases.

But for Ley, even tracking foreign buyers may not result in adequate data.

“Even detecting the existence of foreign buyers is complex because of transnational social networks stretched across the Pacific, allowing local residents or property professionals to stand in as proxy buyers for distant investors,” writes Ley, who nevertheless said taxation measures on foreigners could be a first step. Furthermore, Ley says in addition to addressing transnational wealth migration, B.C.’s real estate industry requires a thorough audit, pointing to recent media reports of tax loopholes in the real estate market, such as “shadow flipping.”

“Ticking a box only means something if we know it’s accurate. What we’ve seen is misstatements have not been unusual in the real estate industry.”

Earlier this month FINTRAC reportedly found real estate firms’ reporting of money laundering is significantly below standards. The Canadian Real Estate Council denied the allegations.

Foreign home ownership restriction examples:

B.C. – none

China – Leasing with proof of residency

Hong Kong – 15 per cent tax

Switzerland – Quotas

Australia – Only new housing stock

Prince Edward Island – Five acres (including Canadian non-residents)