The province collected more than $8 million in Speculation and Vacancy Tax (SVT) from Richmond properties in 2018, with a total of $58 million collected across the jurisdictions affected by the tax.

The SVT was introduced by the provincial government two years ago to curb speculation in the housing market in an effort to make homes more affordable.

Of the 72,548 declared properties in Richmond, the SVT affected 1,579 properties, which is 2.18 per cent.

For those who had to pay the tax in Richmond, the average tax bill was $5,317.

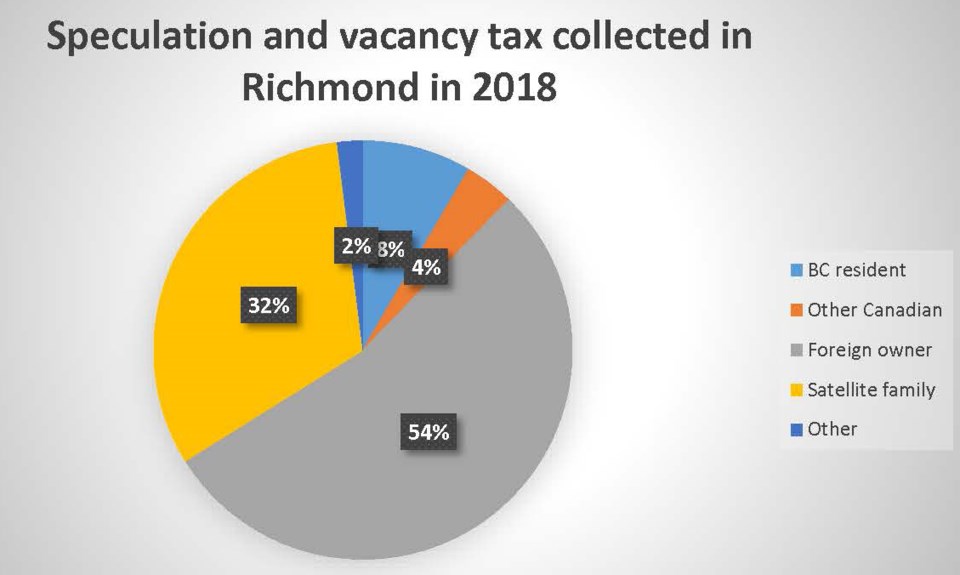

Of those paying the $8.397 million in tax in Richmond, 710 were foreign owners, 379 were satellite families, 220 were B.C. residents, 54 were other Canadians and 195 properties had a mix of owner types.

So far, in 2018 and 2019, $115 million has been collected throughout the province with this tax intended to cool the housing market.

Carole James, Minister of Finance, said the fact that home prices are going down shows that the SVT is working, although she pointed out it is only one part of the plan to make housing more affordable.

James was meeting with the mayors on Thursday morning to discuss the tax and how it will help moderate B.C.’s real estate market and help make housing more affordable.

Despite the government’s message that the tax is a success, the minister was clear that some of the finer details of the SVT legislation were still a moving target, and could be affected by her discussions with the mayors of affected municipalities.

“Part of the reason I’m meeting with the mayors… is to hear from them first-hand the kinds of issues they want to bring forward from their communities,” James said at a news conference on Thursday before her meeting the mayors. “We will continue to review the tax — we’re always trying to improve our taxes so we will be looking at specific cases.”

The minister said that the revenue being collected will go into the Housing Priority Initiatives Account, which is reported publicly, so that taxpayers can see how the funds are being spent to improve housing.

“The minister of housing and myself have been calling on organizations to come forward with their ideas and contributions on affordable housing, and these dollars will help. We’re also open to ideas and contributions from mayors and their councils,” James said.

- with files from Glacier Media