Property tax burdens are expected to shift further from condo and townhouse owners to those of detached homes, in Richmond this year.

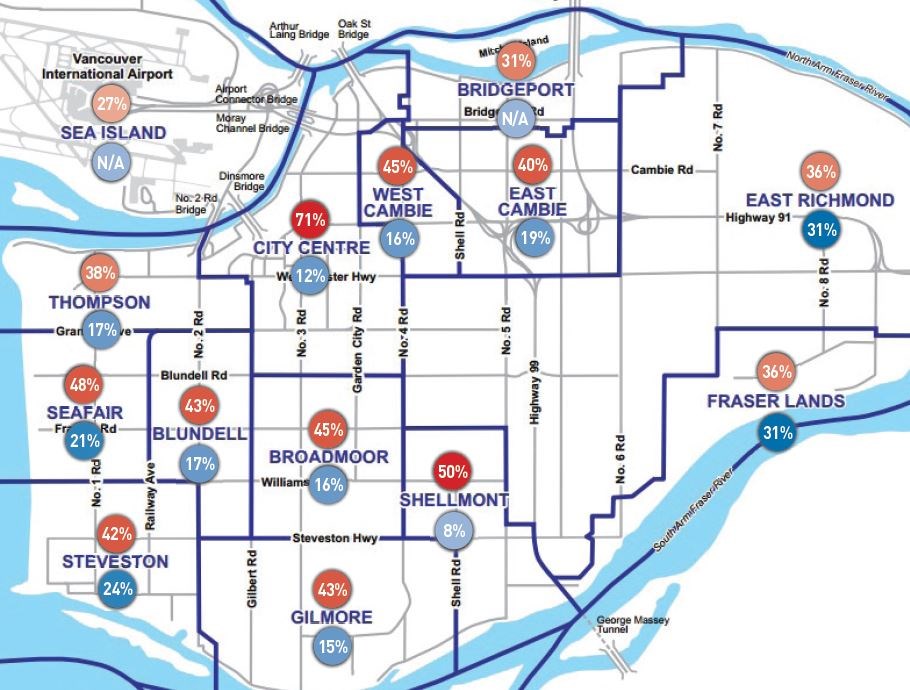

According to Landcor Data Corporation, average assessed values for condos are up 15 per cent; townhouses spiked 32 per cent; and detached homes went up 44 per cent. The City of Richmond reports the overall average increase to residential properties, for 2017, was 35.2 per cent.

The higher/lower one’s increase in home value is relative to the average (35.2 per cent), the more/fewer taxes one should expect to pay.

Richmond’s manager of revenue, Ivy Wong, told city council she expects about 36,000 strata unit owners to pay less tax this year.

Council asked Wong to explore more equitable taxation options, such as different rates among property types (condos vs. houses).

Council also agrees the estimated 14,000 Richmond homeowners losing their Homeowner Grant (HOG) is unfair.

Coun. Chak Au said he wants the province to provide 95 per cent of all homeowners with the HOG, as a standard. This year, the province expects to dole out grants to 91 per cent of them, a figure that is in decline, since 2006, noted Au — who also wants the grant to increase $100, to reflect inflation. Council agreed to Au’s proposal.

Coun. Harold Steves said the grant was initially created in the 1960s to address housing unaffordability. In Richmond, property values skyrocketed when farmland was rezoned for residential purposes.

Now, the grant is available to all, regardless of income/assets.

Council is also advocating for the tax deferral program for seniors (permanent residents, over age 55), who are low-income. They can take a loan, with 0.7 per cent, non-compounding interest, against their home equity.

The program is not based on income. Wealthy seniors can still defer toward a 1.5 per cent GIC, for example.

“There are ways the equity of your home can be a benefit to you without actually moving out,” noted Coun. Derek Dang.

“If your value went up $100,000 and your taxes went up $1,000. You just made $99,000,” noted Steves.

This year, everyone's property tax rate will be impacted by a 2.95 per cent increase for municipal services.