Community groups and social agencies should see a modest boost in the money they receive from the City of Richmond’s bag of casino cash.

On Monday a council committee approved the creation of a new $3 million dollar discretionary account to sponsor community initiatives as well as close to a 70 per cent bump to annual community grants.

The changes are a result of the committee’s unanimous endorsement of a staff recommendation for how to simplify how casino money is dispersed, as was asked by city council late last year given the news of the record windfall.

The $3 million community initiative account was created from a $15 million surplus of unallocated funds. The other $12 million will be put in the capital reserve account.

Coun. Carol Day said she wants to see more guidelines as to what constitutes a "community initiative."

The report indicates the account will allow council to fund one-time initiatives for “social, environmental, recreation and sports, heritage, arts and culture, safety and security and infrastructure projects.”

The city’s policy to use its 10 per cent share in River Rock Casino and Resort revenues — mandated by the province through the B.C. Lottery Corporation — on one-time infrastructure expenditures remains largely in tact.

Casino expenditures to December 2014:

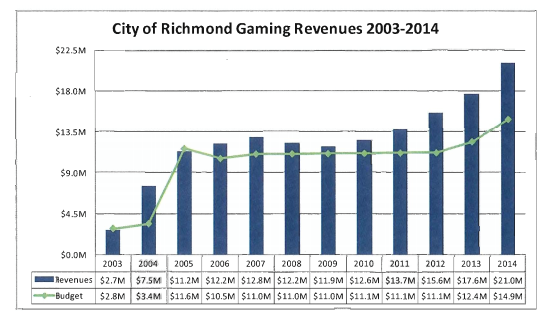

Recently the city had been budgeting to receive $15 million from the casino each year. In 2014, it received $21 million. It’s now budgeting for $18 million.

Put plainly by Coun. Derek Dang: “It’s a good problem to have.”

A fixed $5 million over the next 10 years will pay for Minoru pool and seniors centre while the city will spend $700,000 on four extra RCMP officers.

Starting in 2016, two per cent of revenues will be used to top up the community initiative fund, annually.

Grants will account for 15 per cent of revenues, which should allow council to disperse an additional $550,000 to community groups (a total of $770,000 was dispersed in 2014 from casino funds, plus $1.4 from the city’s operating budget).

As well, 30 per cent will go to capital reserves.

Whatever the city stands to gain beyond its budgeted $18 million will go to capital infrastructure accounts.

Before endorsing the plan, councillors bandied ideas on alternative uses for the money.

Coun. Chak Au suggested the city create an endowment fund, however, he was told by staff that interest rates are too low to have any discernable impact.

Coun. Bill McNulty said he wanted the city to acquire land, but was told by staff that the city is in the midst of reviewing its land acquisition strategy.

There was general consensus that the city needs to use the money for future use; although council recently passed a motion to pare $1.8 million of the casino funds for a one-time property tax cut.

Dang said he worries about being too involved in social agency funding, because it’s a provincial and federal responsibility.

“We don’t want to be taking over for what we shouldn’t be doing,” he said.

Au said more money is needed for grants, whether council likes to admit it or not.

“It’s obvious we have social service agencies facing problems,” said Au, who proposes more grant money be applied to groups to create a short-term (two to three years) financial bridge when their upper-level government funding is cut.

Andrew Nazareth, the city’s chief financial planner, told the committee the staff recommendation (for the casino money dispersements) is only a model and that council can change it as it sees fit. He said the recommendation as based on council’s prior directives to fund one-time expenses.

City council must endorse the plan next week