With 4/20 just a few days away, close to half of the respondents to a new national survey said that they would be put off buying a home if even a legal amount of pot had been grown there, under the upcoming new marijuana legislation.

A Canada-wide survey by real estate company Zoocasa, released April 16, found 47 per cent of respondents said that even a legal amount of marijuana grown in a home would reduce their desire to buy a property. That figure increases slightly to 48 per cent for B.C. residents, but is only 31 per cent in Atlantic Canada.

Respondents were more forgiving of prior marijuana use in a property, but enough said it devalued the home to make users who want to sell up think twice. Nearly 40 per cent of respondents said they believe that an increase in marijuana use in a home would reduce the value of that property – a figure that fell slightly to 37 per cent of respondents in B.C.

Less than a third (32 per cent) of Canadians said that an increase in the number of nearby marijuana dispensaries would reduce local home values, with B.C. respondents agreeing in the same proportion.

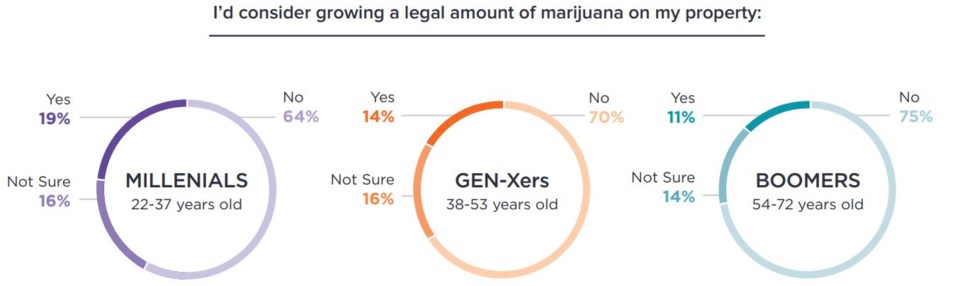

The new legislation will allow for between one and four pot plants to be grown in a private home legally. The survey asked whether respondents would consider growing a legal amount of marijuana at home, and found the results differed by age group:

In a blog on the survey, Zoocasa editor-in-chief Penelope Graham reported that for a home where pot has been grown, even in newly legal quantities, it could be difficult to get a mortgage. Lack of clarity over what is a private home pot-growing operation versus a “grow-op” means that lenders err on the side of caution, with most banks and other A-lenders refusing mortgages on such properties.

Graham adds that insurance companies are similarly cautious, due to grow-op properties tending to have a history of damp and mold from the humidity required to grow pot in large quantities. She writes, “It’s not yet clear whether insurers will adjust these strict criteria post-legalization, and whether those who grow within the legal limit are risking their home coverage."