A West Vancouver senior who says he’s been dinged more than $13,000 and sent threatening letters over the speculation and vacancy tax the province says he owes is questioning how any of those actions will open new homes for people to live in or make them more affordable.

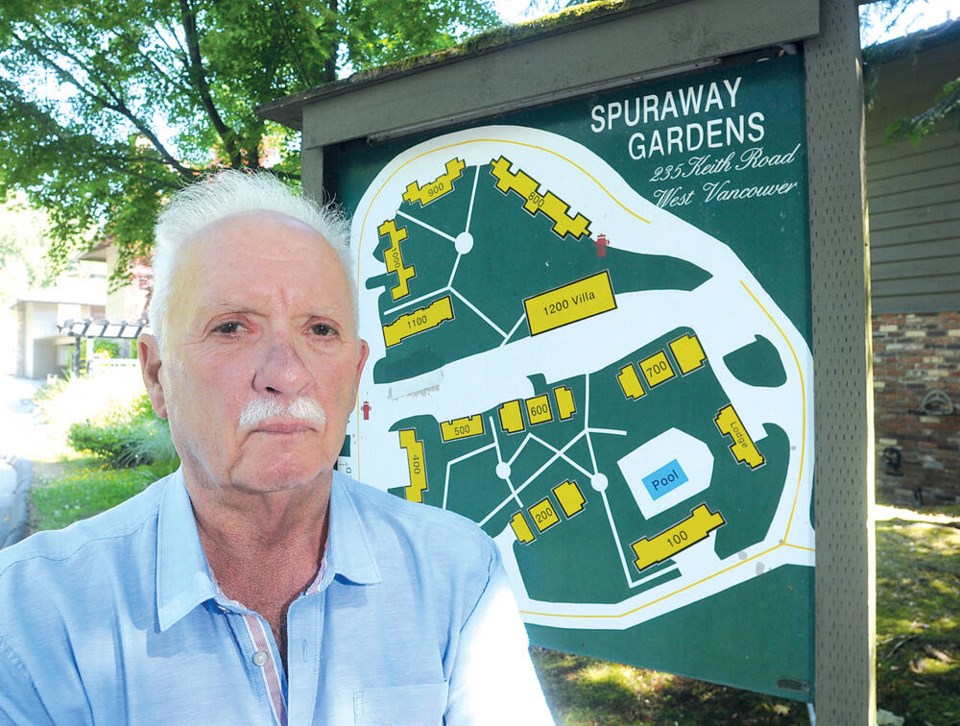

Mike Weatherall, 75, has lived in his West Vancouver townhouse on Keith Road for 15 years, and at no time has that home been empty, he told the North Shore News.

“We’ve been living there full-time,” he said.

But because Weatherall’s common-law wife is a Japanese citizen and is also on title, that makes her ineligible to claim an exemption to the tax as a principal residence on her share of the home, according to the provincial government’s rules.

Weatherall said he tried to talk to staffers in the finance department to see if there was any way around the tax. But the result was he just kept getting passed along to different departments.

Eventually, however, the province sent an alarming notice saying it was placing a lien on his townhouse if the taxes weren’t paid and warned they could send out a bailiff to collect.

“I was born in Canada and paid lots of taxes,” said Weatherall. “I’m supposed to be retired at my age. They’re without any conscience.”

Weatherall said he eventually decided it would be better to pay the money than deal with continuing harassment from the province. “I went to the TD bank, and it was sent electronically,” he said.

But that wasn't the end of it. Weatherall said that shortly after sending the money he got another notice from the province saying they had forgotten to add on the most recent assessment of speculation and vacancy taxes owing – another $4,600.

“You talk about a kick in the stomach,” he said.

'Empty homes tax' also hits occupied homes

According to the province, the tax was brought in to encourage owners not to leave their properties empty and provide more housing that would be available for rentals.

That’s not an issue in Weatherall’s situation.

But the tax is also intended to “ensure foreign owners … contribute fairly to B.C.’s tax system,” according to the government, and discourage foreign speculators from driving up prices.

Weatherall said he and his wife hardly fit the definition of foreign speculators.

“It’s just a cash grab,” he said.

While Weatherall and his wife must pay the tax on the home they live in, because the tax only applies to some parts of B.C., he points out there are still people with empty summer homes in areas like the Gulf Islands and Whistler who pay no vacancy tax to the province.

One of his cousins with a summer cottage on Galiano Island, for instance, doesn’t have to pay the tax, he said.

It’s not the first time owners in West Vancouver have been stung by the tax.

Others face similar tax troubles

Last year, another West Van couple were shocked to find they had erroneously been assessed as owing $69,000 in speculation and vacancy tax and had a lien placed against their home – all without their knowledge.

In that case, the couple eventually got the tax assessment reversed. But it took months of bureaucratic runaround.

Karin Kirkpatrick, the B.C. United MLA for West Vancouver-Capilano and housing critic for the opposition party, said she regularly hears from people in similar situations who’ve been dinged by the tax since it was brought in by the NDP government in 2018.

Kirkpatrick said she was recently contacted by two other couples in a similar situation of being assessed the tax because one of the spouses is a Japanese citizen.

"Obviously these houses are not going to be rented out because the owners are living in them," she said.

Generally, an owner is exempt from speculation and vacancy tax if the residential property is their principal residence.

To be eligible for a principal residence-related exemption, however, an owner must be a Canadian citizen or permanent resident of Canada.

Weatherall said as his wife doesn’t want to give up her Japanese citizenship, and Japan does not allow for dual citizenship, for now, the only solution he and his wife can come up with is to take her name off the property title.

That's a solution other couples caught in the same situation have turned to, said Kirkpatrick - and it's one that worries her.

“That may cause complications and make one spouse vulnerable in the future,” she said.

She added she'd like to see more flexibility and ability to appeal the tax. "People have so many different life situations that aren’t considered in this,” she said.