Metro Vancouver’s housing market has been assessed as “highly vulnerable” for the eighth consecutive quarter by the Canada Mortgage and Housing Corporation (CMHC).

In its latest Housing Market Analysis, which was released April 26 but assesses activity in 2017’s fourth quarter, CMHC said it “detected a high degree of vulnerability” in Metro Vancouver’s market, driven by overvaluation, price acceleration and overheating.

The report said, “Tight market conditions, reflected in our detection of moderate overheating, particularly for lower-priced properties, continue to exert upward pressure on the prices of homes. This can create affordability challenges for households with average local incomes. Rising prices for homes in the sub-$1 million market segment, coupled with rising mortgage rates, have eroded overall affordability further, accentuating CMHC’s valuation models’ detection of overvaluation in the Metro Vancouver housing market.”

It added, “Demand and supply fundamental factors such as population, income, financing costs and land supply cannot account for the current price levels.”

The quarterly Housing Market Analysis analyzes real estate markets across Canada, assessing a combination of four key risk factors: overheating, when demand for homes in the region outpaces supply; sustained acceleration in house prices; overvaluation of house prices in comparison with levels that can be supported by economic fundamentals; and overbuilding, when the inventory of available homes exceeds demand.

The only area where the risk was seen as low in Metro Vancouver was overbuilding. “Despite record-breaking new home construction over the past two years, new home inventories remain low as developers have not been able to keep up with the demand,” said the report.

Eric Bond, report author and principal of market analysis at CMHC, observed that Metro Vancouver’s market varies considerably depending on property type. He wrote, “The majority of the sales-to-available[-listings] ratios for townhouses and apartments remained well within sellers’ territory, as high demand continued to exist for these home types due to their relative affordability in comparison to single-detached homes. In the past two years it has become clearer that the difference in market conditions between property types and locations is primarily determined by affordability.”

National picture

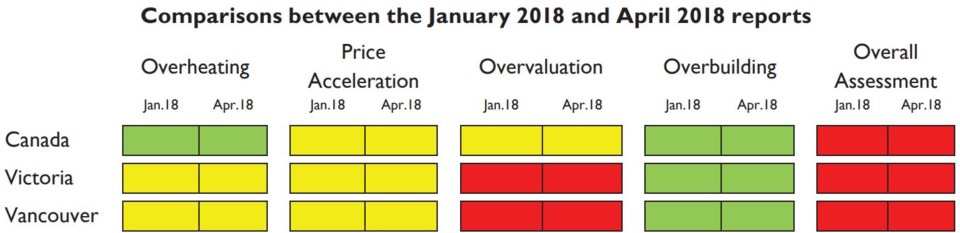

Despite Canada as a whole being assessed as at “moderate risk” in price acceleration and overvaluation, and at “low risk” in overheating and overbuilding, the CMHC pegged the country’s housing market at “high risk” overall, for the seventh straight quarter. The report said that it was the “persistence” and combination of price acceleration and overvaluation that led to this assessment.

Victoria Census Metropolitan Area (CMA) was also assessed as at high risk overall, with the same ratings in each of the four factors as Metro Vancouver.

Alberta and the Priarie cities were assessed as at moderate risk, with Winnipeg the exception at low risk. Toronto and Hamilton CMAs were both assessed as at high risk, their patterns almost identical to those of Vancouver and Victoria CMAs. Low risk of market correction was assessed in all the other cities, including Halifax, Québec and Montréal – with the caveat that the CMHC will increase Montréal’s risk assessment next quarter if prices continue to rise.