Dear Editor,

After receiving our property assessment from the BC Assessment Authority, I am house rich but, after paying our property taxes to the City, cash poor. From 2010 to 2015, the property tax for single family homes has increased by about 134 per cent, while the BC Consumer Price Index (CPI) increased only six per cent. Hence, those still working and those on a fixed income are finding it increasingly difficult to remain in their homes. Most single-family homeowners have lost their seniors grant, while having borne the brunt of this rapid tax increase.

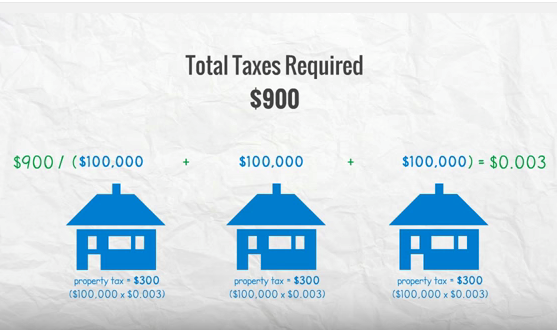

Council states that it has no control over the property tax assessment and that the taxes levied are “relative.” However, council does have direct control of the municipal portion of the property tax collected. Single-family homeowners, all 28,500 of us, need to keep this in mind when we see our property tax bill in June. Our tax bill will be about seven per cent higher than 2016’s.

Council’s spending practices affect all of us but impact single-family homeowners particularly hard. We are being forced out of our homes and out of Richmond by council’s level of spending and policies of densification (the number of single-family homes has remained constant since 2010 at about 28,500).

Condo tax increases are significantly less than ours, hence the lack of complaints from this group.

A few of us have banded together to combat these ever-increasing tax impacts. If you are interested, our fledgling website is RichmondTaxPayersAlliance.org. Our members are unpaid volunteers from Richmond, and we are always looking for new members.

On the back of your assessment notice, it states that you have until Jan. 31 to file a Notice of Complaint with the BC Assessment Authority.

Keep all this in mind when you vote in the May 9 provincial election and the Oct. 20, 2018 municipal election.

Donald Flintoff

Richmond