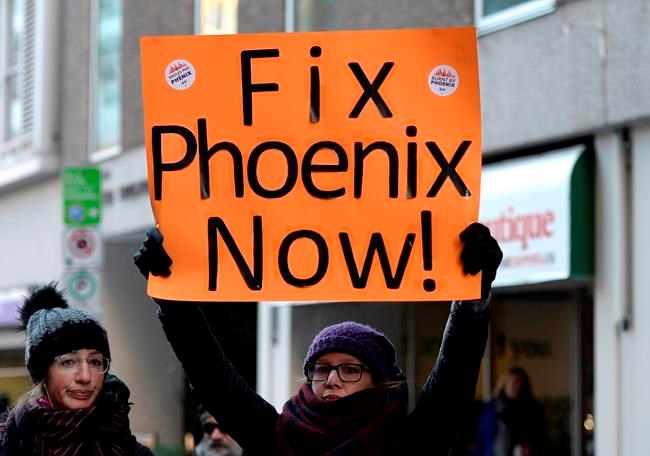

OTTAWA — Canada's biggest civil service union says it is considering taking legal action after the Canada Revenue Agency ruled that damages paid to federal employees in connection with the troubled Phoenix pay system are taxable.

The Public Service Alliance of Canada says it has received notice from CRA that the agency won't review the taxability of the payments.

The payments were part of a contract settlement dealing with the financial, mental and emotional harm caused to government employees who were overpaid, underpaid or not paid at all through the Phoenix system.

Payments of up to $2,500 each were issued in March to civil servants affected by the damages agreement, minus applicable income taxes and other deductions.

In a letter sent to the union, dated April 27, the tax agency turned down the union's request to review the taxation issue.

In part, the CRA said in the letter, the government agency responsible for paying civil servants and the union did not provide the agreed-upon information needed to conduct a review.

"After numerous requests for Treasury Board's co-operation, and direct appeals to (Treasury Board President Jean-Yves) Duclos, they have refused any and all co-operation on the matter," the union said in a statement.

The review was contingent on both the union and Treasury Board Secretariat providing a joint statement, but CRA said none was provided.

"We consented to reconsider our position only if the employer and PSAC provided us with an agreed-upon statement of facts," CRA said in its letter to the union.

"As this did not happen, we have not considered any of the assertions in your draft statement of facts."

The union accused the government of shortchanging the 140,000 federal employees it represents by deducting tax from the payments, arguing that damages settlements are not normally taxed.

The union and government reached a deal last summer to compensate PSAC members affected by failures in the Phoenix system.

The Treasury Board chose not to co-operate with the review out of spite, PSAC national president Chris Aylward said in a statement.

"It's clear they're still angry that PSAC forced them to deliver a better deal for our members," Aylward said.

"They're frustrated that they have to honour the top-up clauses signed with the other unions to match our general damages agreement, and now they're taking it out on PSAC members by sabotaging attempts to get a positive tax ruling."

Treasury Board officials were not immediately available to respond to a request for comment.

But a spokesman said in February that Treasury Board was not blocking a review of the CRA's initial decision on the matter by refusing to issue a joint statement of facts with PSAC, adding that the government had always intended that the damages payments would be subject to "applicable deductions."

This report by The Canadian Press was first published May 3, 2021.

Terry Pedwell, The Canadian Press

Note to readers: This is a corrected story. An earlier version, based on information provided by the Public Service Alliance of Canada, incorrectly attributed a quote about the Treasury Board refusing to co-operate in a review to the Canada Revenue Agency. In fact, the quote came from a PSAC statement.