Some people may say that wealth is not how much you make, but how much you save.

And now, a new app has come up with a creative way to allow people to slowly save and invest their money.

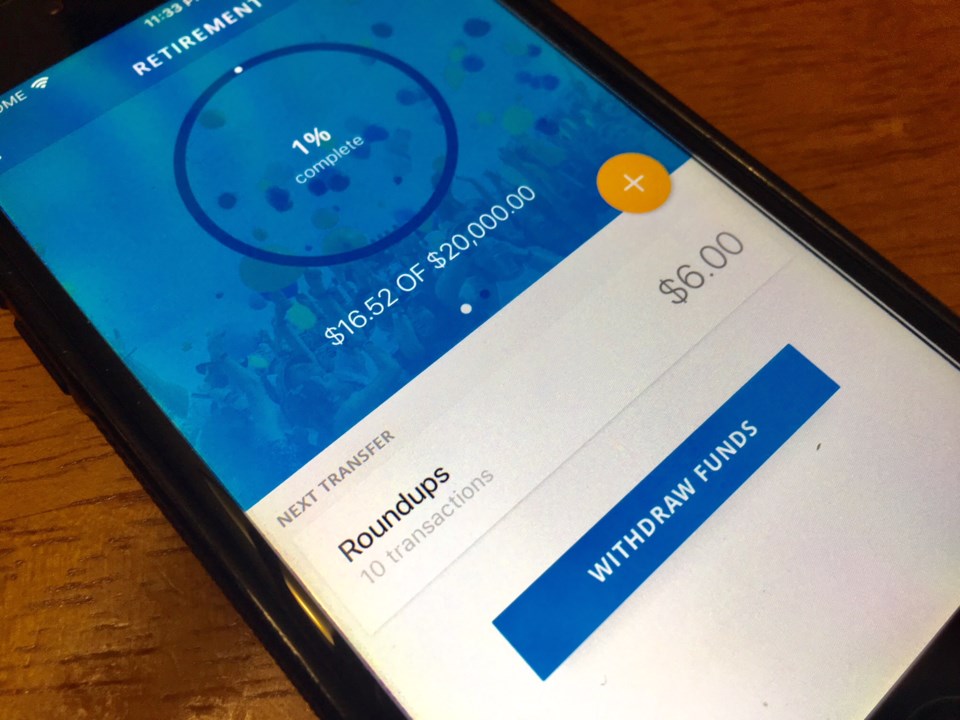

Mylo, a personal finance and investing app, rounds up users’ purchases to the nearest dollar and invests the spare change.

“In Richmond, the median individual, after-tax income is $24,129 (2016 census data for age 15 and over). With that income, many people likely think that investing is out of reach, but with Mylo, you can start investing with as little as one dollar,” said Erica Salvalaggio, the company’s public relations agent.

The CEO and founder, Philip Barrar, said the idea comes from his own experience.

“I tried hard to save and do well with my money, and I found putting away a little bit of money every single time I purchased worked well for me,” said Barrar.

“With the money I saved, I had my first vacation in three years. Now I hope to share this saving technique with others.”

It takes a few minutes to sign up for an account, which links to a credit or debit card.

Every time users make a purchase, Mylo rounds up the amount and puts it into an ETF (exchange-traded fund), which is managed by an investment firm.

For example, Mylo would take 75 cents from a $4.25 latte purchase made on a debit or credit card and put it in the user’s investment account.

Users can withdraw their money at any time, and keep all the returns – a fixed fee of $1 a month is charged by Mylo.

However, Richard Vetter, a financial planner at Richmond-based WealthSmart, raised concerns on the saving-while-spending model.

“We love shortcuts that make it easy to save, and apps like Mylo are a good start for saving beginners to gain more saving awareness and knowledge,” said Vetter.

“But although Mylo makes the saving easier, It could also encourage the overspending by psychologically rewarding that habit through the automatic saving.”

He encourages those using an app like Mylo to link it to their debit card, instead of credit card, “so that they can immediately see the money leave their possession.”