On Jan. 13, 2024, extreme cold gripped Alberta. Temperatures plummeted as low as minus 50 degrees Celsius, dropping wind and solar output and knocking out two large natural gas power plants.

An emergency alert rang out on Albertans’ phones: “Turn off unnecessary lights and electrical appliances. Minimize the use of space heaters.”

The Alberta Electric System Operator (AESO) sent out its own grid alert, warning people to do what they could to minimize the potential for rotating outages.

The grid was in crisis, but for some, the emergency was even more acute. The extreme weather shut down a gas line east of Calgary, leaving more than 900 homes on the Siksika First Nation without heating and prompting a state of emergency.

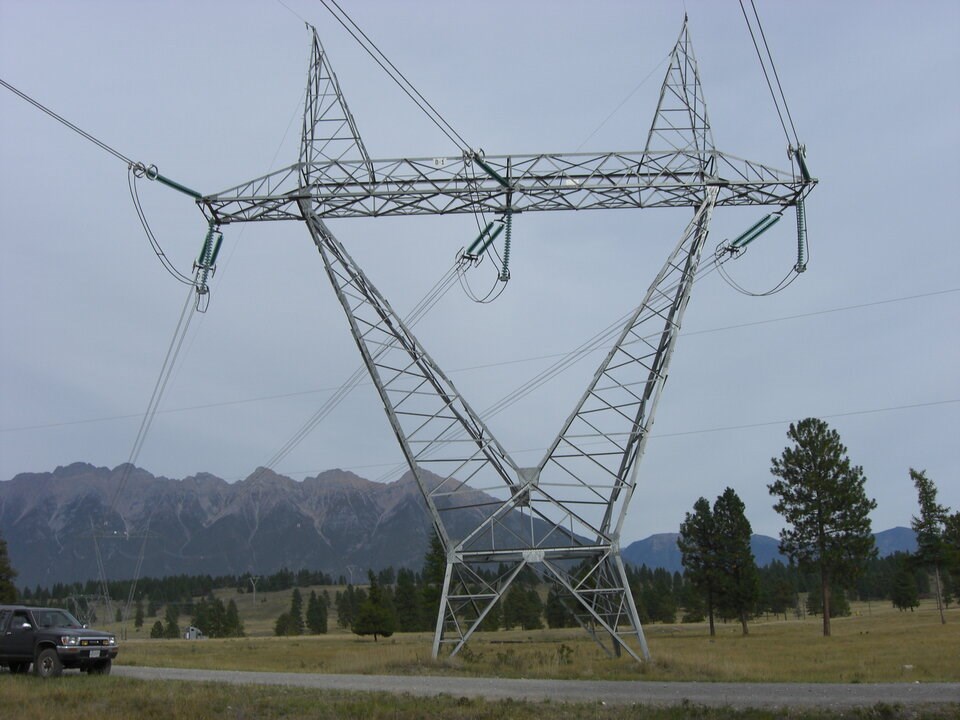

As Alberta’s energy grid teetered with as little as 10 megawatts of reserve power, neighbouring jurisdictions scrambled to help. BC Hydro, for its part, sent 300 megawatts of power through the only place it could — a single collection of interties linking B.C.’s grid near Cranbrook across the border to Calgary.

“We sold them power over the peak and helped them keep the lights on,” said Chris O’Riley, BC Hydro’s outgoing president and CEO.

Faced with a sustained trade war with the United States, Canadian Prime Minister Mark Carney has promised to link the country’s electricity grids from east to west in a “historic nation-building project.”

Proponents argue a national grid would bolster industrial electricity supply, make infrastructure more reliable against extreme weather and reduce costs for ratepayers, while lessening dependence on the U.S. For Carney, it’s all part of a renewed federal push to transform Canada into a clean and conventional “energy superpower.”

Lorena Patterson, president and CEO of the hydropower industry group WaterPower Canada, sees Alberta’s 2024 cold snap as evidence of the immense cost of operating parallel, largely unconnected electric grids.

“We’ve seen this time and time again,” said Patterson. “You need to be integrated with other systems that you can pull on in the events of an emergency.”

But for others, the near-failure of Alberta’s grid reveals a deeper, more systemic problem: Existing transmission lines aren’t transporting energy anywhere close to their capacity.

“It’s crazy,” said Madeleine McPherson, a civil engineer at the University of Victoria and a leading Canadian electricity modeller. “You would think that the hard part is done, and yet here it is and it’s not being used.”

McPherson said the strained relationship surrounding the B.C.-Alberta intertie is symptomatic of a country lacking a national regulatory system to mediate and guide provinces as they modernize their grids.

“At the end of the day,” said McPherson, “I think the issue that we have is foundationally one of trust.”

An underperforming energy link

Built in 1986, the transmission lines connecting the two provinces were designed to carry 1,200 megawatts east into Alberta and 1,000 megawatts west into B.C. But the Alberta-bound line has rarely reached its eastward capacity over the past two decades.

Records show Alberta has consistently limited transmission to between 40 and 60 per cent of what can be delivered, even though B.C. allowed in over 90 per cent of the intertie’s rated capacity.

Since 2007, AESO has been obliged under the province’s Transmission Regulation to restore the capacity of the cross-border transmission line. Yet efforts to unlock its full potential have since stalled. In March 2023, AESO unilaterally reduced the commercial import capacity further, to between 250 and 350 megawatts — roughly a quarter of the line’s rated capability.

Alberta’s electric utility operator maintains the limits are necessary to protect the reliability of Alberta’s grid. It cites the risk of the inter-tie going down and triggering a wider blackout. That’s a valid concern, said McPherson. But where Alberta’s logic breaks down is in its repeated failure to upgrade its grid to safely handle the B.C. inter-tie, she said.

“The fact they haven’t, that’s political,” McPherson added. “That’s insane.”

This situation — where Alberta benefits from the intertie as a contingency while not paying for its full value were it in a regulated market — has profoundly frustrated the B.C. government.

In its Clean Energy Strategy last June, B.C. openly criticized AESO for unilaterally restricting clean electricity sales from B.C. to Alberta, viewing it as a move to limit competition for Alberta’s natural gas-fired generators.

Six months after the Alberta cold snap, then minister of energy, mines and low carbon innovation Josie Osborne wrote a letter to Alberta Minister of Affordability and Utilities Nathan Neudorf, raising concerns that Alberta’s proposed market redesign “may further harm B.C.’s interests.”

First reported on by The Narwhal, the letter pointed to complaints from electricity providers in Alberta, including Suncor Energy Inc., which had filed a request to place a charge on imported energy.

“They’ve just got their own generating facility in the backyard, and they’re using it,” said McPherson, referring to some Alberta electricity producers. “Spot market prices skyrocket, and they don’t care.”

McPherson’s modelling indicates that boosting the capacity of the existing transmission would almost certainly reduce electricity costs in Alberta. The increased supply would pressure generators like Suncor to lower prices — benefiting consumers in Edmonton and Calgary, though potentially shrinking profits for some Alberta electric companies.

A spokesperson for Neudorf’s office said that ensuring reliable, affordable electricity is the Alberta government’s “top priority.” They cited a December 2024 letter from Neudorf to the head of AESO, directing the Alberta utility to restore the B.C.-Alberta intertie to at or near 950 megawatts — 79 per cent of its capacity — by the end of 2026.

The statement added that the Alberta government is taking actions to reduce red tape and “strengthen interties with B.C.”

That gesture does not appear to have softened B.C.’s concerns. Weeks after Neudorf’s directive, BC Hydro held a meeting in Vancouver on grid connections with Alberta. A slide deck from the meeting warns that Alberta’s market restructuring proposals could allow AESO to dictate which customers access the intertie.

Without long-term service agreements, BC Hydro’s electricity would become less attractive and less valuable to new and existing customers. The document reiterated that, despite legislative requirements and assurances, “there has been no restoration in import capability to date.”

B.C. Energy Minister Adrian Dix initially agreed to an interview but later declined to speak with BIV.

“What you’re seeing here are the symptoms of provincial energy fiefdoms — provinces that look first and foremost to protecting and building out their own grid,” said Mark Zacharias, a special advisor to Clean Energy Canada and its former executive director.

“It’s almost a cultural legacy, cultural baggage on how provinces trade and share electricity. That’s going to dissipate over time.”

Electricity as an economic imperative

Like most interprovincial trade barriers, the ongoing friction between B.C. and Alberta carries significant financial costs for both sides.

Canada is expected to need twice as much electricity by 2050 to achieve is climate targets and meet growing demand, according to Clean Energy Canada. The growth in demand could be driven even higher as more data centres come online to support the development of artificial intelligence, said Zacharias.

“It could look a lot like the crypto mining a couple of years ago, where suddenly there was another Site C worth of demand emerging in B.C.,” he said, pointing to the latest and largest dam in the province.

One of the cheapest ways to meet that demand is to build more renewable energy projects in places like Alberta and Saskatchewan and then hook them up to neighbouring provinces to improve reliability, say many electricity grid experts.

Modelling by McPherson’s national research team — the Sustainable Energy Systems Integration and Transitions Group (SESIT) — suggests that for every dollar spent on building grid interties between B.C. and Alberta, the two provinces could save five dollars.

“There’s gonna be a lot of money on the table if we were to build something like that,” said McPherson. “How big your piece of the pie is compared to mine is something that would have to be negotiated. But the point is, there’s a pie on the table that we can split up.”

Part of those savings comes down to Canada’s vast geography. Time zone differences mean electricity demand peaks earlier in the east. An interconnected grid would enable provinces to assist each other during those morning and evening spikes.

While B.C. and Alberta each produce over 70 terawatts of electricity annually — tying them as Canada’s third- and fourth-largest electricity generators after Ontario and Quebec — their energy mixes differ dramatically. B.C. generates 95 per cent of its electricity from hydro, whereas, in 2021, 85 per cent of Alberta’s power came from fossil fuels.

That dynamic is slowly shifting. Alberta’s renewable energy share has doubled in recent years and now regularly makes up a third of the province’s energy mix every month.

BC Hydro has recently approved just under a dozen wind and solar projects to keep up with electricity demand over the coming years. But with flatter land and more powerful, consistent winds, building a wind farm in Alberta costs two to three times less, according to SESIT’s modelling. It’s a potential that could make the Prairie province a wind energy heavyweight.

“There’s winners and losers, and that is the fundamental truth everywhere,” said McPherson of the potential for an interconnected grid. “And so how do you compensate the losers? How do you allocate cost to the winners?”

Imagine a windy, sunny morning in southern Alberta. Turbines are spinning, solar panels are basking and energy is flowing into B.C., allowing it to maintain water behind its dams even as people are waking up and turning on their lights. By the evening, as wind dies down and the sun sets, BC Hydro’s still-full reservoirs are opened, sending electricity down transmission lines in both provinces.

Designed effectively, the interplay could balance the grids over time, lowering electricity costs and strengthening them against extreme weather. The goal, experts say, is to build a grid “bigger than the weather,” allowing one jurisdiction to aid another facing drought or a cold snap.

Canada is too big for single weather event to impact the entire country and shift people’s priorities, McPherson said. But the current U.S. administration’s tariffs could be having a similar effect.

“Maybe that’s the sort of severe weather event that’s going to change people’s perspectives,” she said.

Finding the perfect partner

Building a truly reliable grid across provincial borders wouldn’t necessarily require a coast-to-coast network. McPherson’s modelling suggests that linking hydro-dominated provinces with the others would be sufficient to keep costs down and create robust backups.

About 82 per cent of Canada’s electricity currently comes from renewable sources of energy or non-emitting sources, including wind, solar, hydro and nuclear. Hydropower makes up the bulk of that energy supply, especially in places such as B.C., Manitoba and Quebec, where dammed reservoirs act as massive batteries, producing more than 90 per cent of the provinces’ generating capacity.

When combined with variable renewables like wind and solar in the Prairies, or nuclear generators in Ontario, they create what McPherson calls a series of “perfect dance partners.”

“We have this sort of perfect patchwork of provinces — hydro-dominated B.C. next to Alberta; hydro-dominated Manitoba next to Saskatchewan; hydro-dominated Quebec next to Ontario,” she said.

Zacharias expects electricity demand and the economic benefits of cheap, shared renewables to mount so much that provinces will have little choice but to cooperate as provincial pairs. That’s when the federal government can step in, he said, convening provinces to have the conversation and providing capital to build.

“But it will have to be voluntary,” Zacharias warned. “Alberta still needs political will to do that.”

Despite clear benefits, significant obstacles remain. For decades, Canadian provinces have prioritized building transmission lines south to the U.S. over east-west connections. That’s partly due to Canada’s Constitution order, which grants provinces jurisdiction over energy, and a historical tendency for provinces to focus inward.

“It doesn’t have to be that way,” said BC Hydro’s O’Riley. “We are interested in having a different relationship with Alberta.”

Shifting BC Hydro’s electricity trading eastward would require confidence in Alberta as a reliable energy partner. Currently, Powerex — BC Hydro’s trading arm — buys electricity from out of province when it’s cheaper or there’s a shortfall due to drought. In fiscal year 2024, the utility imported 13,600 gigawatt-hours — about a quarter of its power needs — at a cost of $1.4 billion.

At the same time, Powerex sells 90 perc cent of its exported electricity south to a regional U.S. grid, typically when prices are high.

Another roadblock: McPherson says the current intertie linking B.C. and Alberta continues to be used as a weapon against further development. Many people, she said, rightly question why they should build more transmission lines if the provinces aren’t making proper use of the first one.

But she also warned that doing nothing to bolster interconnected grids because of past failures is equally problematic — and leaves Canada increasingly isolated.

“Everywhere in the world knows that this is a huge issue,” McPherson said. “Canada is the only place where we’re basically doing nothing.”

Lessons learned in other jurisdictions

Canada’s is not the only country that has struggled to connect its grid. Currently on sabbatical, McPherson has spent months travelling to places like South Korea, Australia and the United States to study their interconnected grids and identify best practices to bring back to Canada.

Living on a sailboat in the South Pacific, she is currently drafting a manuscript based on over 200 interviews and thousands of pages of notes. So far, McPherson has identified a handful of crucial, albeit unglamorous, preconditions Canada must meet if it hopes to build a robust interconnected grid.

First, she said provinces will need reciprocity agreements for fair energy exchange and a cost allocation mechanism for shared capital investments like new transmission lines — ideally proportionate to each province’s benefit, she said.

Other preconditions include new, politically independent bodies focused on optimizing the grid and planning across jurisdictions; a new financial model for electricity markets with clear regulatory approval processes and rules that set out how the costs and benefits of a new transmission lines are passed onto ratepayers and investors; and an authority backed by provinces with the power to permit and approve projects.

Then there’s the need for joint operational agreements, which Canada currently does not have.

“There has to be some kind of way for BC Hydro and the Alberta Electricity System Operator to communicate with one another: ‘I need power. Can you send me power?’” McPherson said.

Respecting the provinces’ independence on energy, Patterson said Ottawa could still play a big role in easing regulatory burdens. In many cases, provincial electricity rules are doubled up or contradict each other, slowing down or stifling efforts to work together, she said.

The industry group head said the federal government could also kick-start national electricity projects by providing investment tax credits to utilities so they can write off capital investments in clean energy projects or transmission lines.

Ultimately, multiple experts agreed that the success of a national grid hinges on sustained political will to secure an affordable and reliable flow of electricity across the country. Without the necessary institutional and governance structures, existing transmission lines, like the Cranbrook-Calgary intertie, will remain underutilized.

“Just having a line isn’t really good enough,” McPherson said. “It needs to sound good to politicians.”

The vision, however, faces significant headwinds in Alberta. On May 1, Premier Danielle Smith said her government would challenge the federal government’s clean electricity regulations, arguing they “threaten the reliability of Alberta’s electrical grid” and could increase costs by $30 billion.

That move — combined with the Smith government’s restructuring of the province’s electricity market and seven-month moratorium on wind and solar in 2023 — appear to have dampened investor confidence in Alberta’s renewable energy market, a report from the Pembina Institute found this week.

Despite the hurdles, O’Riley remains optimistic.

“There’s responsibility on both sides, and you have to be willing to make changes to relieve the barrier,” he said. “This has been tried before. But we think it’s worth trying again.”

For Zacharias, the potential chilling effect of tariffs on Canadian energy exports, as well as countervailing levies on the import of electricity from the U.S., could push provincial utilities to look east and west like never before.

McPherson, too, sees hope, and says she’s contemplating an early return to Canada to contribute to whatever national grid plans the new Liberal government ends up following through on.

“I don’t think it’s an insurmountable challenge,” she said.