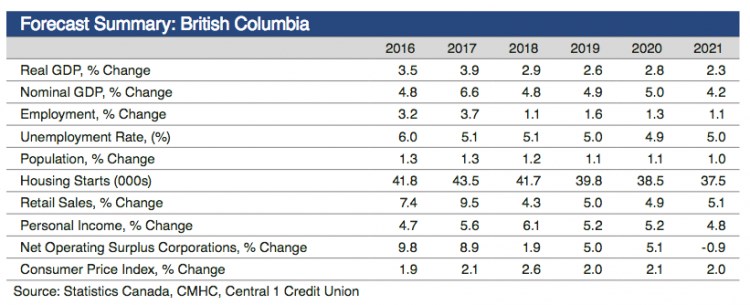

British Columbia has seen annual economic growth of more than 3.5 per cent over the past four years, but this is expected to slow down and remain slower until at least 2021, according to a Central 1 economic forecast released August 22.

New mortgage qualification rules and the foreign-buyer tax have slowed down the housing market in the province, and this, along with slow job growth and decreasing exports, is putting a damper on overall economic expansion. In 2018, the economy is expected to increase by around 2.9 per cent, according to the report, which is “still healthy,” Central 1 points out. Economic growth is expected to be around 2.6 per cent in 2019, 2.8 per cent in 2020 and 2.3 per cent in 2021.

“Not surprisingly, the recent tightening of mortgage lending policy and provincial housing measures has slowed demand, which will feed into a lower pace of housing starts and residential investment in 2019 onwards and dampen growth,” said Central 1 deputy chief economist Bryan Yu.

Employment growth is expected to continue to moderate, which the forecast said is related to a labour shortage. Wages are rising, however, but consumer spending is slowing down compared with the past few years.

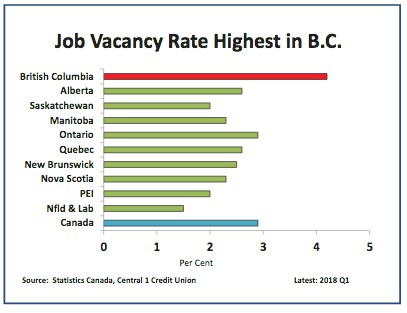

Central 1 forecasts the province’s unemployment rate will remain around 5 per cent. B.C. has the highest job vacancy rate in the country, according to Statistics Canada. Average employment increased 3.7 percentage points – or by around 80,000 jobs – in 2017; this was the highest growth on record since 1994. This is expected to slow to around 1.1 per cent this year.

According to the report, “the employment trend has turned ice-cold since the second half of 2017, with levels down in five of the first six months of 2018.” Year-over-year growth was negative in June; this was the first time in five years that employment decreased over a 12-month period.

The economy will see growth from companies investing in operations and expansion, and some major project construction will contribute to the increases. Liquefied natural gas investment remains a positive possibility for the province, but uncertainty remains surrounding final investment decisions for several key projects.

Exports will continue to increase overall – especially service exports – but the future isn’t entirely clear.

“The export environment faces significant uncertainty given an increase in protectionist sentiment from south of the border,” Yu said.

Trade disruption is not expected to affect B.C. in 2018 – at least not in a material way – but starting in 2019, it is a risk for exports and investments, as trade tariffs on Canadian goods and services are widening.