Brian Wourms pays his household bills regularly and on time and usually doesn’t think twice about it.

But this week when he got his January bill from Fortis BC he took the time to look at what he was being charged to heat his Prince George home and nearly jumped out of his skin when he saw what he was being dinged for the BC carbon tax.

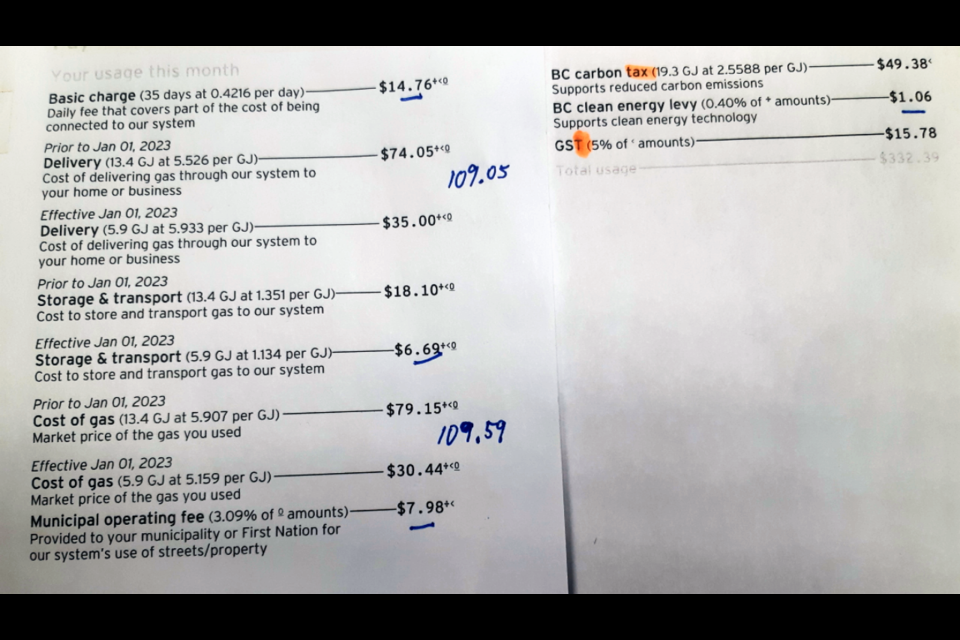

The amount of the tax - $49.38 - is nearly half of what he’s being charged for the natural gas he used the previous month.

“I never look at my bill, I just pay it, but last night for whatever reason I actually looked,” said Wourms. “I burnt 19.3 gigajoules of fuel and I have to pay $49.38 on $109.45 in fuel and when I did the math it’s 49 per cent. That’s based straight on how much I used.

“If we went to the gas pump and had to pay 49 per cent carbon tax, there would be a revolt. Why are we paying 49 per cent carbon tax on clean energy?”

The Fortis BC bill shows Wourms is being billed $2.56 for each gigajoule of gas, so the 19.3 GJ he used to fuel his furnace and heat his hot water tank cost him $49.38 in carbon tax. The cost of delivering the gas to his home for the month was $109.50, which doesn’t factor into determining the tax bill.

He was also billed $1.06 to the BC Clean Energy Levy (0.4 per cent of the amount of gas used), and $15.78 for the federal goods and services tax (GST) which amounts to five per cent of the entire bill.

“You’re paying GST on top of your B.C. tax, you’re paying tax on a tax, and that is wrong,” said Wourms.

“There’s 25,000 businesses and homes in Prince George and at $40 a chop, that’s a million dollars a month. Can you imagine what the hospital pays or any of the hotels pay?”

The B.C. government began collecting carbon tax in 2008 to encourage consumers to shift away from fossil fuels and help the province achieve its targets for reduced greenhouse gas emissions.

But that motivation for the tax doesn’t wash with Wourms, who lives in a cold climate and depends on his furnace to keep his pipes from freezing on days when the thermometer outside his house hits -40 C. Yet people in Prince George pay the same carbon tax rate and residents of Vancouver, where it rarely gets bitterly cold.

“More people need to be aware of this,” said Wourms. “There’s all sorts of uproar with Canfor (mill closures), with the regional district and taxes, and increases in assessment values, but that’s nothing compared to this.”

The carbon tax applies to the purchase of all fuels, including gasoline, diesel, heating fuel (oil and natural gas), propane and coal. People living with a disability can apply for a tax refund to reduce transportation costs.

In April 2022 the carbon tax rate increased from $45 to $50 per tonne of carbon dioxide emitted. The government is required by law to return carbon tax revenues to British Columbians and uses the money to reduce personal income taxes and cut some business income taxes to boost the overall economy.

To offset the costs of the increased tax for low- and moderate-income earners, the Climate Action Tax Credit annual rebate increased in July to $193.50 per adult and $56.50 per child.