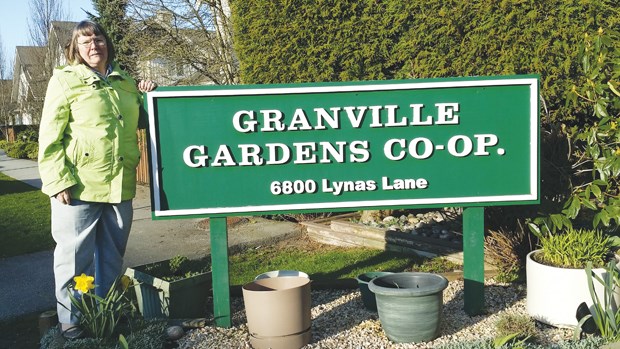

Gail Thomas has lived at the Granville Gardens townhouse co-operative since 1983. With a disability that has left her with mobility issues into her senior years she managed to raise three children and is now an empty-nester.

Lately she has been trying to move out of her two-bedroom unit and acquire one of the co-op’s scooter-friendly suites.

Thomas’s rent is subsidized according to her disability income but that may very well change when her co-op’s federal subsidies end in January, 2019.

Starting this year and extending into 2024 many co-ops such as Granville Gardens will be facing a funding crisis because federal subsidies end as their mortgages expire. The federal government subsidized the mortgages to benefit low- to moderate-income residents. Around the late 1980s is when many of these subsidized co-ops were built with such a funding plan (typically a 35-year mortgage).

Last week the Metro Vancouver board of directors passed a motion asking the province to take action on the imminent funding shortfall.

“This is a vote of support for seniors, people with disabilities, single parents, new Canadians and many others who need help from the provincial government to remain in their homes,” explained Thom Armstrong, executive director of the Co-operative Housing Federation of BC (CHBC).

In Richmond, about a third of all co-op households pay a monthly charge relative to their income. The subsidies vary from co-op to co-op. As the mortgages have matured buildings in poor condition or with no facility reserve are at greater risk of forcing out subsidized renters. It’s believed the co-ops will need to increase the number of units charging market value.

The CHBC also notes that many co-ops faced serious repairs (leaky roofs) over the years and had to take out a second mortgage, which means the end of federal subsidies, but doesn’t necessarily mean the end of a mortgage.

If a solution isn’t found Thomas fears losing her home and being forced from her community where she has forged many friendships and connections.

“If the subsidy is no longer given to us, I will no longer receive a subsidy and I’ll be paying the maximum and I’m on a fixed disability income,” explained Thomas, noting this will put serious pressure on her basic daily living expenses such as food.

“It doesn’t make me feel secure because if I don’t get a subsidy I don’t know if I’ll have to move out. I don’t know if I could find something else in Richmond,” added Thomas.

The CHBC estimates by 2020, 3,000 households in B.C. will be affected by the end of subsidies.

In Richmond 293 co-op households are facing an end to their subsidies starting in July, 2016. Most of the subsidies in the city end between 2022 and 2024.

Armstrong is asking the provincial government to work with his organization to find a solution. He said discussions with BC Housing have been “positive.”

He noted the subsidy crunch is ultimately up to the provincial government.

“Since those agreements were signed, the provinces and territories have negotiated the transfer of responsibility for housing from the federal government, along with financial assistance to meet their new obligations. It stands to reason, therefore, that the province would consider extending its reach to help low-income co-op members,” said Armstrong via email.

He added that the federal government should pass on the savings of the co-op program to the provinces.

Coun. Bill McNulty, a member of the Metro Vancouver housing committee, said the end of subsidies is another “download” on the province and municipalities.

“We need to have the development community put in more affordable housing units,” said McNulty, adding affordable housing results in more “balanced communities.”