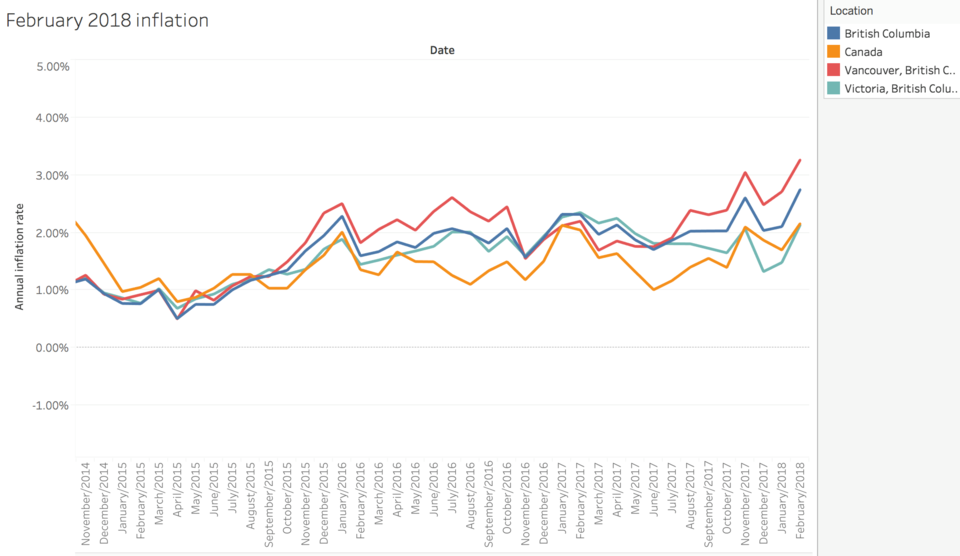

British Columbia’s annual inflation rate has hit its highest level in seven years.

In February 2018, B.C.’s annual inflation rate was 2.75 per cent; the last time it surpassed this was in May 2011, when the annual inflation rate reached 3.08 per cent. British Columbia had the third highest annual inflation rate in the country, behind only Saskatchewan and P.E.I. Vancouver’s inflation rate also hit a peak of 3.27 per cent, its highest point in 10 years and the highest of any major Canadian city including Toronto which recorded an annual inflation rate of 2.64% last month.

The country, overall, had an inflation rate of 2.16 per cent, the highest in over three years. Canada’s February inflation was higher than the Bank of Canada’s (BOC) projection of 1.9 per cent.

B.C.’s annual inflation rate grew by 0.65 points in February from 2.11 per cent in January. This exceeded the country’s overall increase by 0.46 points. It was also one of the larger increases across all provinces only behind Alberta and the Maritime provinces.

“The 2.2 per cent year-over-year rate is only just above the Bank of Canada’s target, and as such isn’t exactly telling policymakers that they need to up the pace of rate hikes,” said Andrew Grantham, chief economist for CIBC, in a note to investors.

Grantham said inflation will continue to increase in the following months, peaking at 2.5 per cent by the middle of the year. He explained that ultimately slowing growth in the national economy will weigh heavier on the Bank of Canada’s decision to raise rates than will higher inflation rates. As a result, the CIBC is holding to its projection that interest rates will only move once more this year.

James Marple, senior economist for TD Bank, agreed with Grantham and, in a note to investors, said the summer will be the most likely time for rate hike from the BOC.

The major contributor to the large annual inflation increase was the rising price of gasoline, growing 12.6 per cent over the past year. Food purchases from restaurants, car purchases and mortgage interest costs also helped drive inflation increases. While consumer prices generally increased, some product experienced falling prices including computers and video equipment, falling 5.9 per cent and 10.1 per cent respectively.